Netflix Earnings Due

As US earnings season rolls on, focus today falls on Netflix which will report Q1 earnings at the market close. On the back of the last quarter’s weaker-than-forecast EPS result, investors are looking to see whether the streaming giant bounced back over Q1 or earnings worsened. Ahead of the results, Netflix shares are holding just below YTD highs. The stock has seen a 36% rally this year. The rally has stalled over recent weeks, however, and with risk appetite seen softening this week, the stock is vulnerable to a drop lower unless we see today’s results coming in at or above forecasts.

Forecasts For Q1 Results

Looking at the numbers for today, Wall Street is forecasting Q1 EPS of $4.51 on revenues of $9.275 billion. If seen, this will mark a solid uptick from the prior quarter and the same quarter a year prior, and should therefore see the stock move higher as a result. However, along with the headline results, traders will be looking at the details of today’s release.

New Subscriptions in Focus

In particular traders will be looking at the number of new subscriptions. Despite the crackdown on password sharing and a price increase, Netflix saw growth of just over 13 million subscribers in Q4 last year. While the company has offered no guidance for subscribers in Q1, the figure being bandied around on Wall Street is 4.45 million. If we see this forecast satisfied or topped, this should help drive fresh bullish sentiment in the stock. However, if we see new subscriptions undershooting this forecast this will likely cause some uncertainty among investors, leading the stock lower near-term.

Technical Views

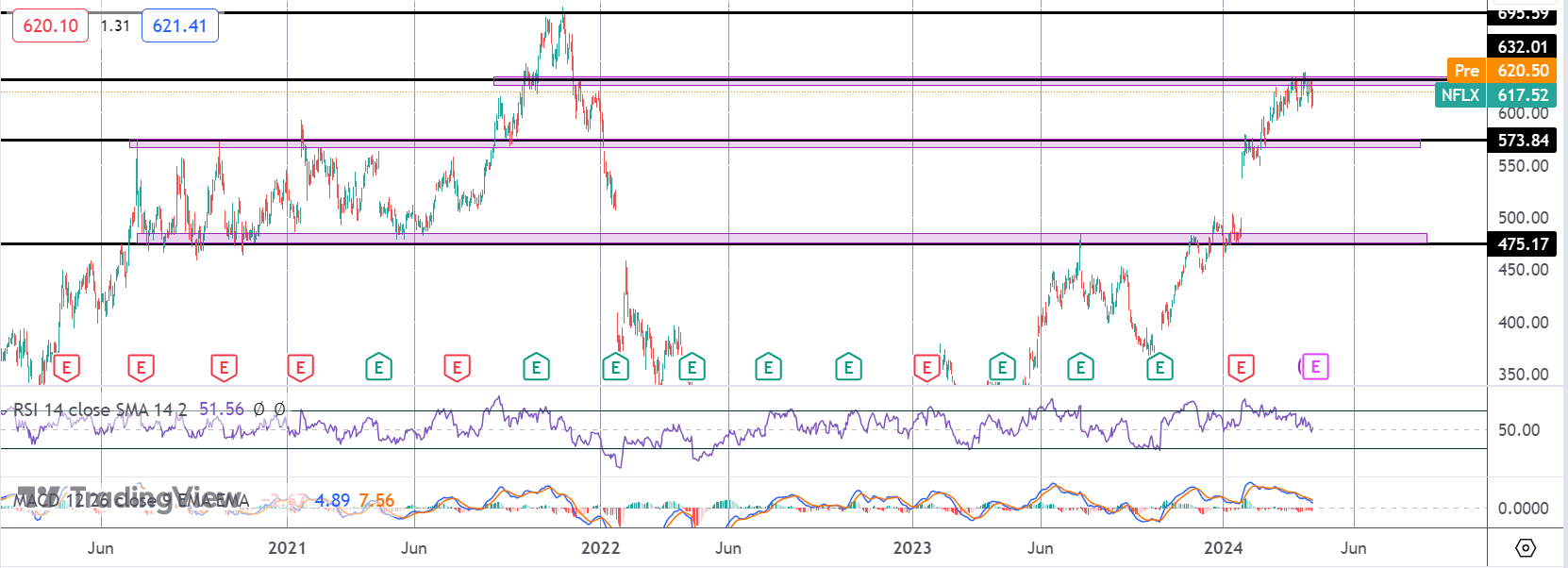

Netflix

The rally in Netflix shares has stalled for now into the 632 level. Momentum studies have turned bearish, highlighting risks of a move lower. However, while the 573.84 level holds as support, focus is on a continued push higher and a test of the all-time highs around 695.59.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.