Daily Market Outlook, April 16, 2024

Munnelly’s Macro Minute…

“Asian Markets Follow Wall Street Into The Red”

On Tuesday, Asian stock markets experienced widespread declines, mirroring the sell-off on Wall Street the previous day. This was driven by a surge in bond yields after a report revealed stronger-than-expected U.S. retail sales growth in March. The data raised concerns that the US Fed may delay lowering interest rates in June. Additionally, traders remained wary of geopolitical tensions in the Middle East. Most Asian markets ended Monday with lower closing prices. In light of the latest data, CME Group's FedWatch Tool currently suggests only a 21.6 percent likelihood of a quarter point rate cut in June. In China, Q1 GDP growth came in at 5.3% year-on-year, surpassing forecasts, although March retail sales and industrial production fell short of expectations.

Turning to the UK, recent labor market data showed a mixed picture. While the unemployment rate rose to 4.2% in the three months to February, exceeding predictions, annual wage growth remained steady at 5.6%, defying expectations of a slight decrease. Underlying wage growth, excluding bonuses, declined less than anticipated to 6.0% from 6.1%. These wage figures, alongside expected continued CPI inflation decreases, may impact the timing and magnitude of potential Bank of England rate adjustments. Tomorrow morning, the UK will release March CPI data. Headline inflation is anticipated to edge closer to the 2% target, with a projected decrease to 3.1% from February's 3.4%. This aligns with expectations of a drop below 2% in April figures, factoring in Ofgem price reductions. Service sector price pressures appear weaker compared to the previous year, while moderation in food price inflation and softer retail prices, such as clothing and footwear, are expected due to adverse weather conditions. However, petrol prices saw an increase in March compared to the previous year.

The German ZEW survey of professional investors will also be released today, with anticipation of further improvements in the expectations index for economic activity, while the current economic situation index is expected to remain weak.

Later today, market focus will shift to US housing data and industrial production, following recent positive surprises in economic indicators, including stronger-than-expected retail sales. Consequently, expectations for Federal Reserve rate cuts this year have been scaled back.

This week will see several central bank speakers, partly due to the IMF/G-20 meetings. Bank of England Governor Bailey is set to speak later today, with markets assigning roughly even odds to the possibility of the first rate cut occurring as early as June. Federal Reserve Chair Powell will participate in a moderated Q&A session.

Overnight Newswire Updates of Note

China First-Quarter GDP Grows 5.3%, Beating Estimates

Israel’s Military Chief: Will Respond To Iran’s Weekend Attack

US, Europe Seek To Dissuade Israel From Striking Back Against Iran

US Speaker: House Will Vote On Ukraine And Israel Aid This Week

Fed’s Daly Says No Urgency To Cut, Policy In A Good Place

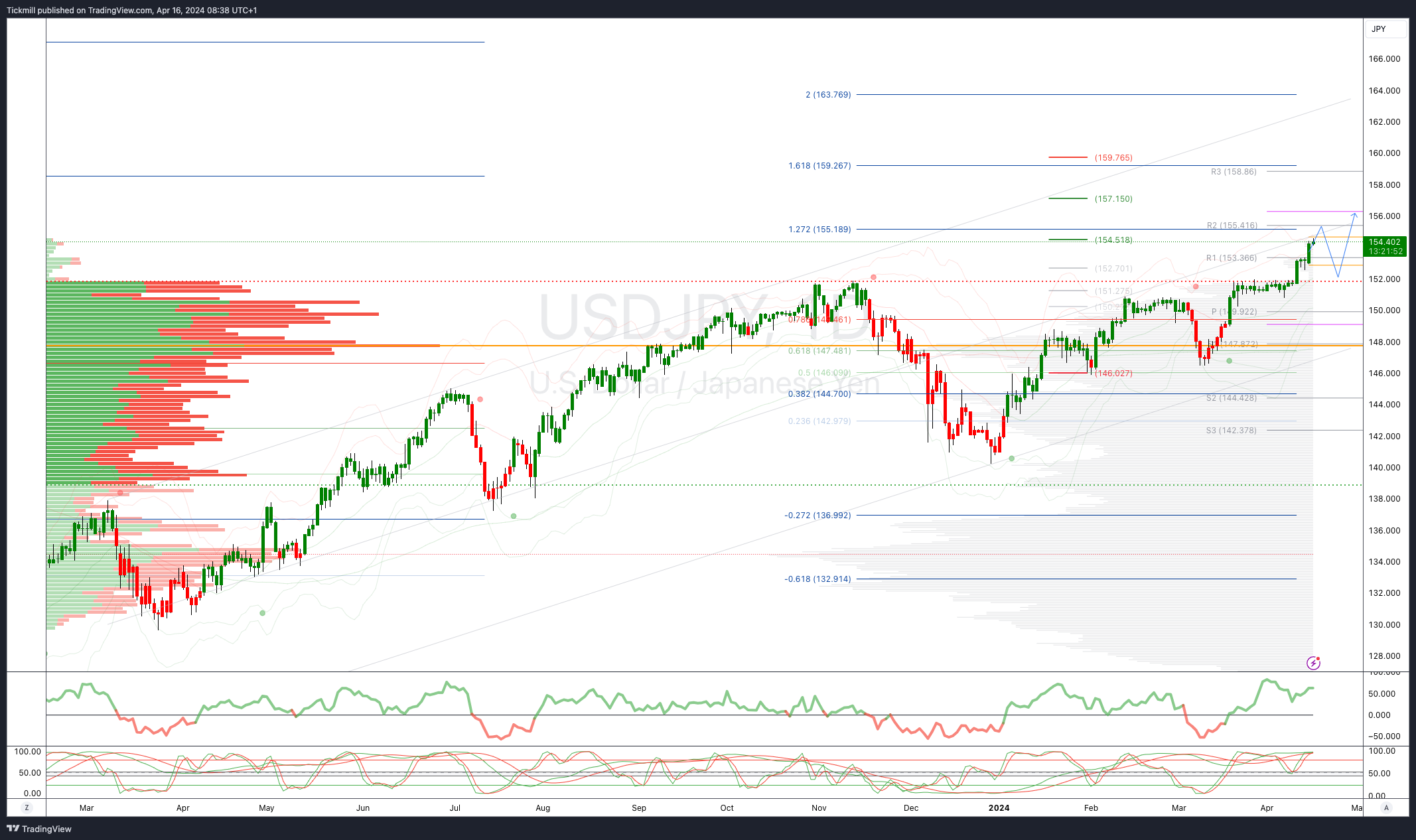

Japan's Yen Hits A Fresh Three-Decade Low Of 154

China Loosens Grip On Yuan By Weakening Fix Amid USD Strength

Tesla Plans To Lay Off More Than 10% Of Workforce

Lockheed Wins US Missile Defence Contract Worth $17 Bln

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0610-20 (1.2BLN), 1.0650 (801M), 1.0660-70 (2.6BLN)

1.0700 (1.2BLN, 1.0750 (1.5BLN), 1.0800 (2.7BLN), 1.0820-25 (1.8BLN)

USD/CHF: 0.9050 (350M), 0.9140 (476M)

GBP/USD: 1.2450 (321M). 0.8530 (200M),0.8550 (225M)

AUD/NZD: 1.0900 (594M)

AUD/USD: 0.6500 (1.1BLN), 0.6600 (740M)

USD/CAD: 1.3700 (890M), 1.3715-25 (800M)

USD/JPY: 153.00 (510M), 153.50 (310M), 154.05-10 (480M)

AUD/JPY: 97.60 (805M)

FX option risk premiums are trading at January highs, with implied volatility showing a risk premium compared to realised volatility. The premiums have increased for all currencies and expiration dates, with the 1-month expiry being the benchmark. G10 implied volatility for 1-month expiry has reached new highs since January, compared to 2+year lows in mid-March. There has been a significant increase in volatility premium for USD and JPY calls compared to puts, indicating risk aversion and the potential for further USD gains, as well as potential JPY intervention. Key barrier levels are at EUR/USD 1.0600 and USD/JPY 155.00.

CFTC Data As Of 12/04/24

Equity fund managers raise S&P 500 CME net long position by 9,236 contracts to 939,368

Equity fund speculators trim S&P 500 CME net short position by 32,395 contracts to 333,288

Japanese yen net short position is -162,151 contracts

Euro net long position is 32,723 contracts

British pound net long position is 28,252 contracts

Swiss franc posts net short position of -31,764 contracts

Bitcoin net short position is -153 contracts

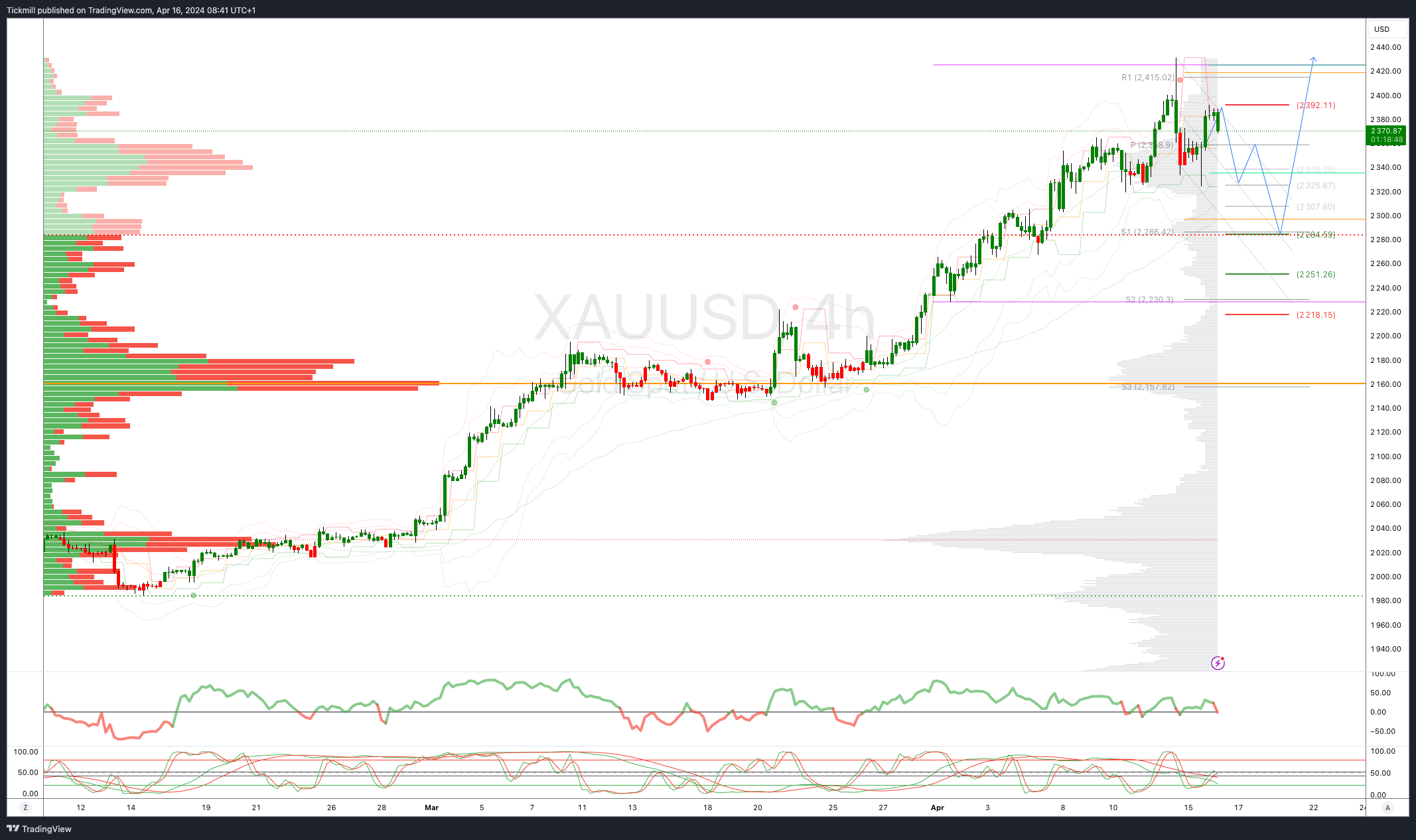

Gold NC Net Positions climbed from previous $199.3K to $207.3K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5104

Daily VWAP bearish

Weekly VWAP bearish

Above 5110 opens 5150

Primary resistance 5180

Primary objective is 5000

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.25

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2560 opens 1.2650

Primary resistance is 1.2650

Primary objective 1.2350

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

XAUUSD Bullish Above Bearish Below 2395

Daily VWAP bullish

Weekly VWAP bullish

Below 2380 opens 2330

Primary support 2284

Primary objective is 2430 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!