Daily Market Outlook, April 17, 2024

Munnelly’s Macro Minute…

“Another Powell Flip Flop On Rate Cut Timing Weighs On Risk”

On Wednesday, global markets continue navigating through some volatility, especially with the anticipation of the Federal Reserve's actions regarding interest rates. The fluctuation in Asian currencies and the recovery of the MSCI Asia Pacific Index suggest a mixed sentiment among investors. The decline in the dollar after its recent surge is noteworthy, particularly in its impact on emerging-market currencies. The varied performance of Asian stocks, with Japan facing losses and mainland China seeing gains, reflects regional differences in market dynamics. The efforts by the Chinese securities regulator to address concerns over new stock exchange rules likely contributed to the recovery of Chinese stocks. The stability of Treasury rates, despite reaching new highs for the year, indicates a cautious approach among investors following Federal Reserve Chairman Powell's remarks regarding the timeline for achieving the central bank's inflation target. The persistence of inflationary pressures, as indicated by key inflation indicators surpassing estimates for the third consecutive month, underscores the challenges facing central banks in managing monetary policy in a post-pandemic economic environment.

The latest UK March CPI inflation data has just been released, revealing a decrease to 3.2% from February's 3.4%. Although slightly higher than the expected 3.1%, it marks the lowest rate since September 2021. The core measure, which excludes energy and food, also saw a drop to 4.2% from 4.5%. Services inflation decreased to 6.0% from 6.1%, surpassing market expectations of 5.8%. The decline in food prices and softer retail prices, particularly in clothing and footwear, contributed to the overall CPI decrease, partially offset by petrol prices. Looking ahead, April's inflation is expected to sharply decrease to around the 2% target with the incorporation of a lower Ofgem energy price cap.

Eurozone March CPI inflation figures are anticipated to confirm the preliminary estimate, when released today. The preliminary estimate indicated a decline to 2.4%, surpassing expectations, while core CPI fell to 2.9%, the lowest in over two years. The ECB has indicated the possibility of a rate cut in June, ahead of the BoE or the Fed, given progress in inflation and sluggish growth.

Today, much market participant attention will be on central bank speakers, many of whom are in Washington DC for IMF and other meetings. Notably, BoE Governor Bailey will take part in a moderated discussion and ECB President Lagarde will join a conversation at 19:00. Other speakers include the BoE’s Greene and Haskel, and the Fed’s Mester and Bowman.

Overnight Newswire Updates of Note

Fed’s Powell: Likely To Take Longer To Meet Conditions To Cut Rates

Fed's Barkin: CPI Data Has Not 'Been Supportive' Of Soft Landing

BoC’s Macklem: March CPI Data Shows Econ. Moving In Right Direction

Lagarde Says Germany May Have Turned Corner After Major Shocks

ECB’s Villeroy: ECB To Cut More In 2024 And 2025 After June

Bank Of England's Bailey Sees Strong Evidence Of Falling UK Inflation

Jeremy Hunt Says Rate Cuts Would Lift UK Mood, Hints At Autumn Vote

Inflation In New Zealand Eases But Near-Term Rate Cuts Unlikely

United Airlines Cuts 2024 Aircraft Plan During Growth Challenges

LVMH Sales Growth Slows Along With Demand For Handbags

Israel Reportedly Finalizes Plans For Counter-Strike Against Iran

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600-10 (1.1BLN), 1.0630-35 (1.8BLN), 1.0650 (482M)

1.0675 (435M), 1.0700 (2.1BLN)

USD/CHF: 0.9100 (1.2BLN). EUR/CHF: 0.9725 (248M), 0.9750 (310M)

GBP/USD: 1.2500 (938M), 1.2745-60 (1BLN)

EUR/GBP: 0.8480 (429M), 0.8520 (330M)

AUD/USD: 0.6470-80 (1.4BLN), 0.6560 (330M), 0.6575 (617M)

AUD/NZD: 1.0750 (462M). NZD/USD: 0.5900-05 (1.4BLN)

USD/CAD: 1.3800 (1.4BLN)

USD/JPY: 153.00 (936M), 153.50 (721M), 155.00 (572M)

EUR/JPY: 163.85 (273M). CHF/JPY: 167.00 (200M)

The potential for a significant increase in the value of the dollar is increasing. The likelihood of a rate cut by the U.S. in September has decreased to 63%. The expected amount of easing in 2024 has also been reduced to 39 basis points, with the prospect of only one cut in that year. It is expected that the U.S. interest rate will likely remain higher than that of other major currencies. The U.S. dollar is considered to be more liquid and safer, and the U.S. has a larger number of asset markets compared to other nations. As a result, investors are more inclined to consider the greenback as a favorable option for parking their cash.

CFTC Data As Of 12/04/24

Equity fund managers raise S&P 500 CME net long position by 9,236 contracts to 939,368

Equity fund speculators trim S&P 500 CME net short position by 32,395 contracts to 333,288

Japanese yen net short position is -162,151 contracts

Euro net long position is 32,723 contracts

British pound net long position is 28,252 contracts

Swiss franc posts net short position of -31,764 contracts

Bitcoin net short position is -153 contracts

Gold NC Net Positions climbed from previous $199.3K to $207.3K

Technical & Trade Views

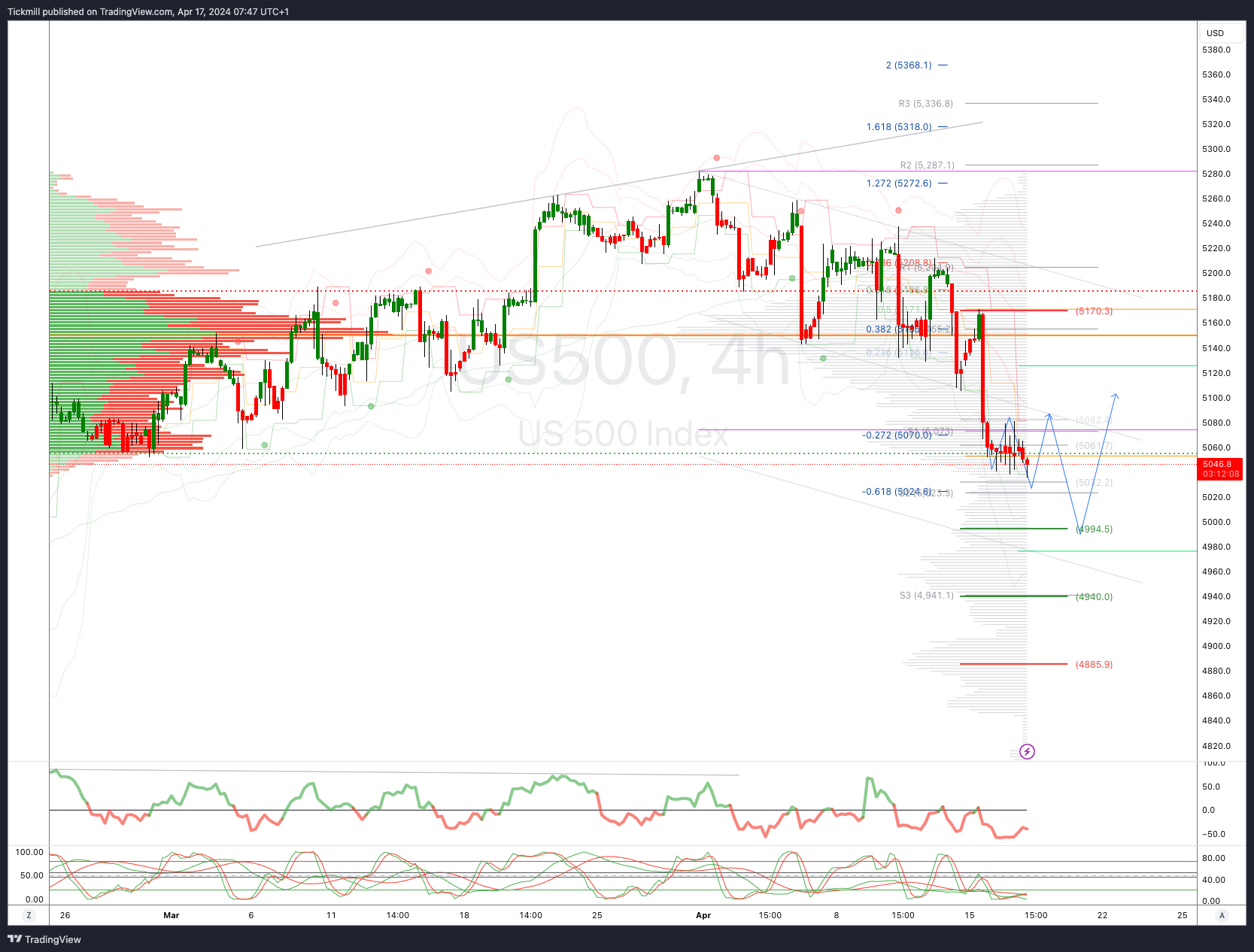

SP500 Bullish Above Bearish Below 5104

Daily VWAP bearish

Weekly VWAP bearish

Above 5110 opens 5150

Primary resistance 5180

Primary objective is 5000

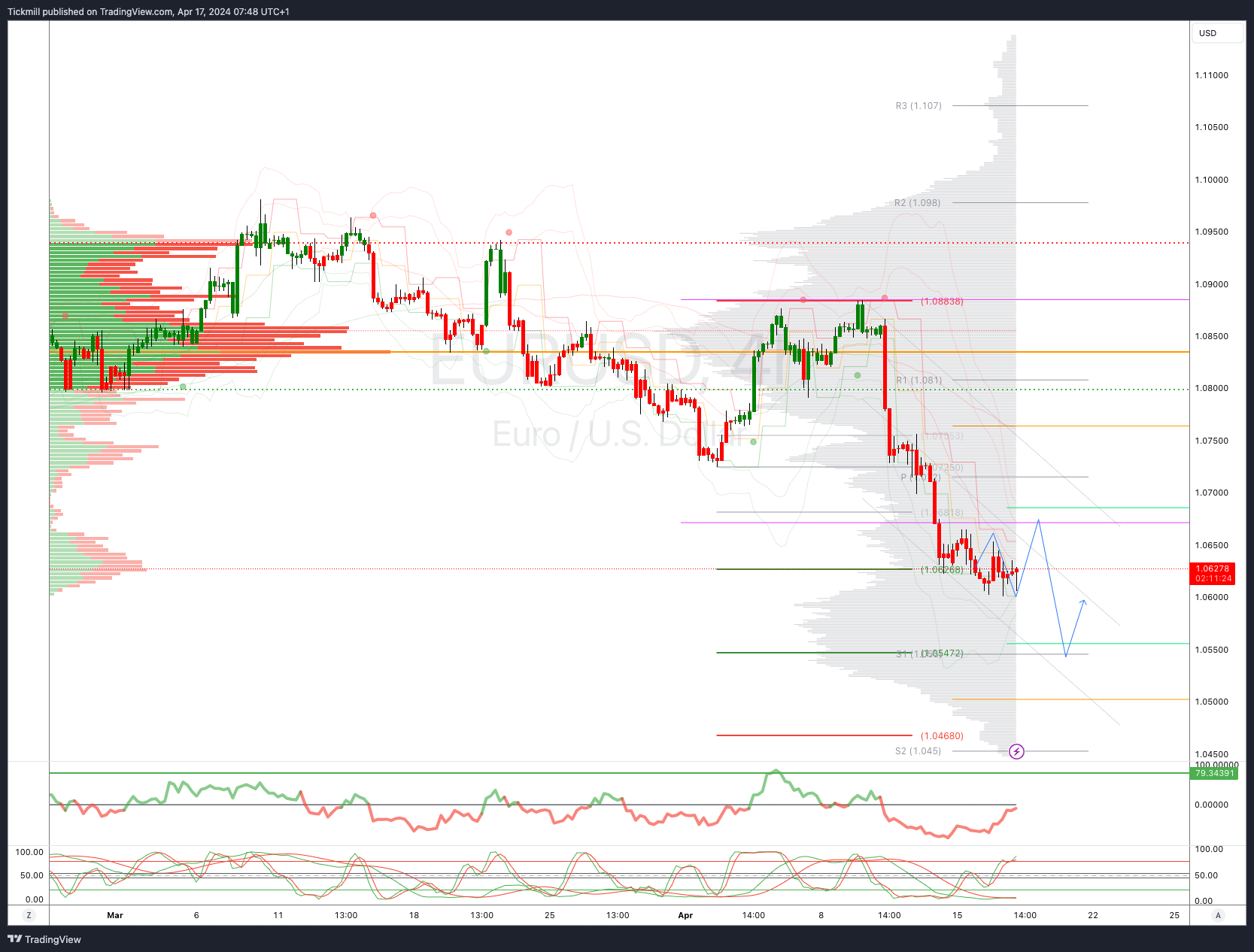

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

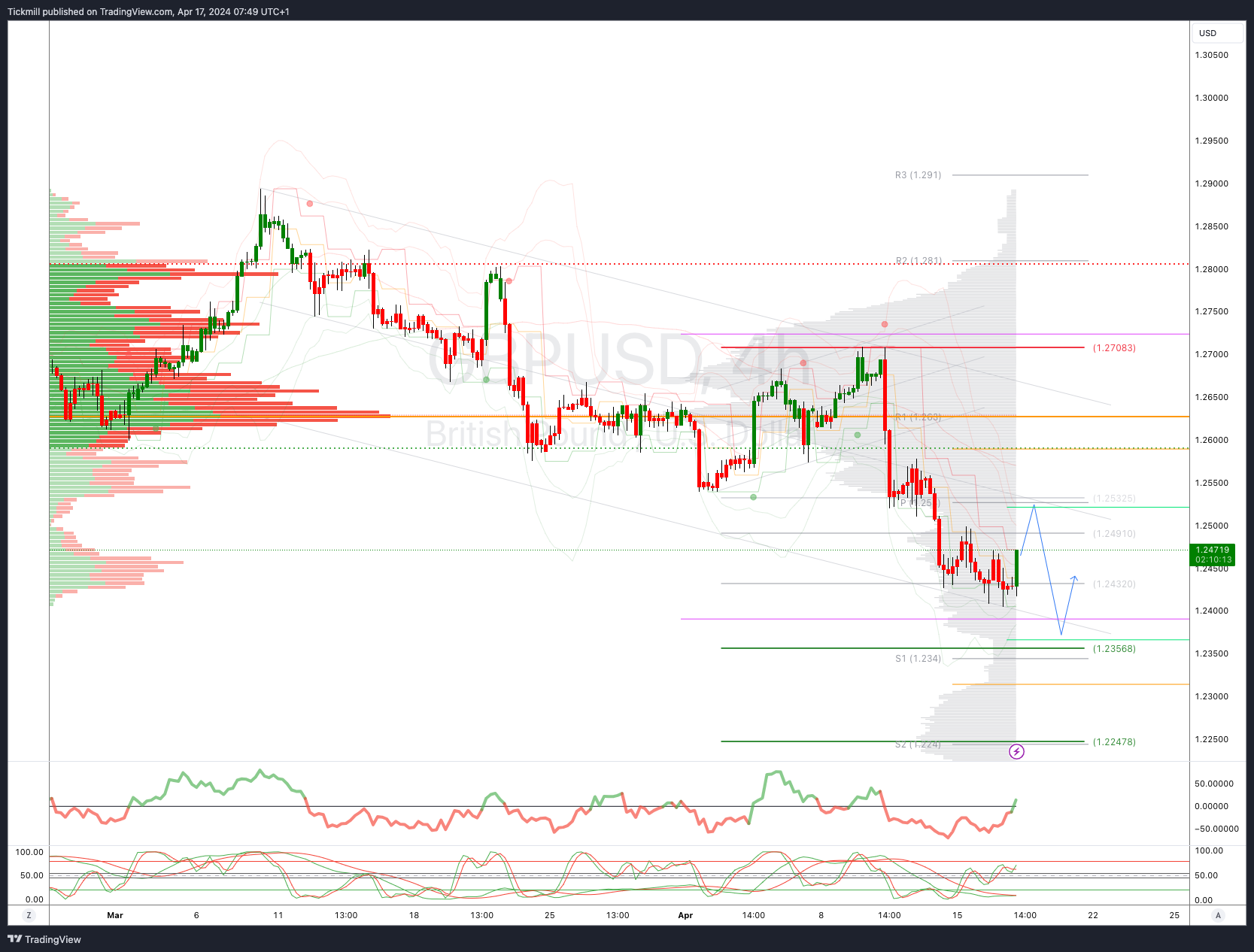

GBPUSD Bullish Above Bearish Below 1.25

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2560 opens 1.2650

Primary resistance is 1.2650

Primary objective 1.2350

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

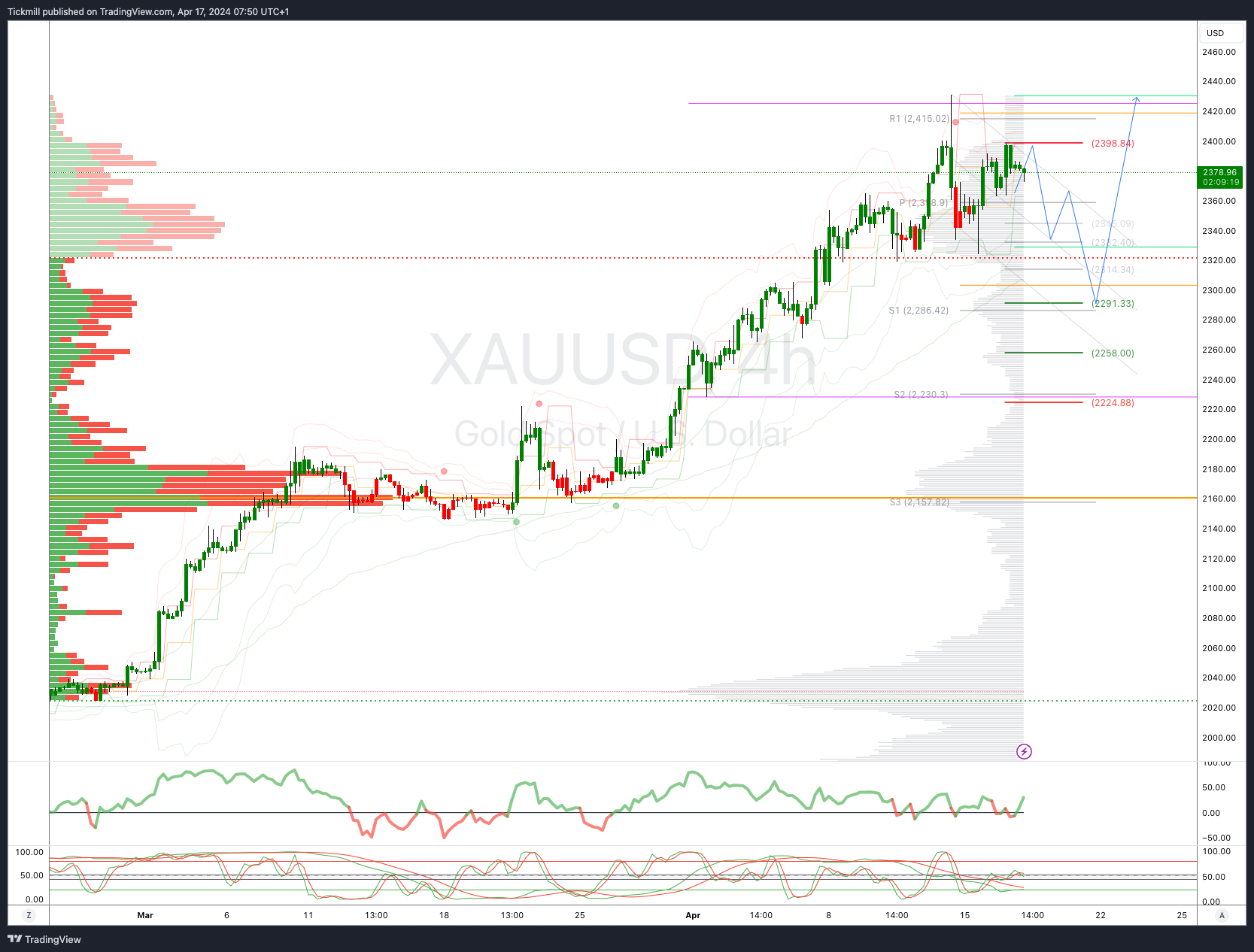

XAUUSD Bullish Above Bearish Below 2395

Daily VWAP bullish

Weekly VWAP bullish

Below 2380 opens 2330

Primary support 2284

Primary objective is 2430 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!