Daily Market Outlook, April 18, 2024

Munnelly’s Macro Minute…

“Scant Econ Data, CB Speakers On Deck Along With Tech Earnings”

Asian stocks rose on Thursday as authorities' resistance to a strengthening dollar helped stabilize exchange rates and restore public confidence in the region's financial systems. Following a joint statement by US Treasury Secretary Janet Yellen and the finance ministers of Japan and South Korea expressing concerns about the weakening of the two Asian currencies, the value of the yen and won increased against the dollar. A global measure of emerging market currencies was set for a second day of gains after hitting a low point for the year earlier in the week, indicating some stabilization. The dollar index fell for a second day, while Treasuries remained relatively unchanged after a rally on Wednesday. Equities in China and Japan saw gains. The oil price has retreated, with Brent crude falling below $88 per barrel, nearing its lowest level in three weeks. This reflects optimism that tensions between Iran and Israel will not escalate further. Additionally, more US Federal Reserve policymakers have cautioned that persistent US inflation could delay interest rate cuts.

Looking at the day ahead, economic data is light in the UK and the Eurozone. In the US, focus will be on the weekly jobless claims data, which has been trending at unusually low levels in recent weeks, indicating a resilient labor market. However, this may not reassure markets regarding potential interest rate cuts by the Federal Reserve. The release of existing home sales for March in the US will also be watched. While sales saw a significant rise in January and February, a modest decline is expected for March. Nonetheless, the overall trend suggests that the housing sector has stabilized, although rising bond yields could pose a threat to this recovery.The April Philadelphia Fed survey will offer insight into current economic conditions, although its volatility makes it challenging to discern underlying trends.

Global financial leaders continue to provide commentary at the International Monetary Fund and World Bank Spring meetings in Washington. ECB vice-president Luis de Guindos presents the bank's annual report, joined by colleagues Joachim Nagel, Isabel Schnabel, Mario Centeno, Gediminas Simkus, and Boris Vujcic at various venues. Megan Greene of the Bank of England has taken a hawkish tone in recent comments, warning of inflation risks from the Middle East and pushing back against expectations of quicker rate cuts compared to the United States. Later today US investors will parse earnings from Netflix and TSMC as tech earnings get underway.

Overnight Newswire Updates of Note

Traders Pile Into Contrarian Bet That Fed Will Front-Run Cuts

Fed's Bowman: Inflation Progress Slows And Possibly Halts

Mester Says Fed Can Hold Rates Steady, Not In a Hurry to Cut

Lagarde Says Euro-Zone Economy Is Showing Signs Of Recovery

ECB’s Nagel: Probability Of ECB June Rate Cut Is Increasing

ECB's Vasle Sees Rates Much Closer To 3% At Year-End

ECB’s Centeno Says It’s About Time To Change Monetary Policy

BoE’s Andrew Bailey Insists UK ‘On Track’ To Quell Inflation

BoJ's Noguchi: Short-Term Policy Rate Adjustment Likely To Be Slow

Australian Jobs Surprisingly Fall, Giving RBA Scope For Patience

Japan's Kanda: G7 Statement Reconfirmed Commitment On FX Stance

China Reiterates Need For Steady Yuan Amid Fragile Confidence

US Reimposes Oil Sanctions On Venezuela After Broken Election Promises

Israel Reportedly Considered Striking Iran On Monday But Decided To Wait

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0625 (609M), 1.0635-40 (1.1BLN), 1.0650 (909M)

1.0670-75 (623M), 1.0700 (910M)

USD/CHF: 0.9000 (928M), 0.9100 (200M).

EUR/CHF: 0.9700 (649M), 0.9725 (239M), 0.9750 (576M)

GBP/USD: 1.2390-1.2400 (1BLN), 1.2450 (705M), 1.2500 (230M), 1.2640 (720M)

EUR/GBP: 0.8490 (800M), 0.8535 (400M), 0.8590 (281M), 0.8650 (786M)

AUD/USD: 0.6370 (596M), 0.6435 (1.5BLN), 0.6500-15 (609M), 0.6540-45 (700M)

NZD/USD: 0.5900 (745M), 0.5995 (2.3BLN)

AUD/NZD: 1.0850 (304M), 1.0900 (302M). USD/CAD: 1.3750 (1BLN)

USD/JPY: 153.00 (6BLN), 153.80 (1BLN), 154.00 (755M), 154.50 (1BLN)

155.00 (895M). EUR/JPY: 164.00 (500M), 164.95 (489M). AUD/JPY: 99.25 (505M)

Thursday saw a dominance of sellers in the FX option markets, leading to a significant increase in implied volatility amid geopolitical risks and policy divergence, despite demand coming from long-term lows. It was challenging to assess the amount of risk premium each party demanded, while realized volatility remained relatively low throughout the week. Risk experienced a modest recovery, accompanied by a weakening USD. Sellers of option implied volatility reappeared, particularly in shorter dates. Without further escalation in the Middle East, there's potential for increased downside volatility. USD calls, notably for EUR/USD, witnessed substantial premium gains, although the easing process was gradual. The expiration of significant strikes on Thursday amplified their influence in calmer markets.

CFTC Data As Of 12/04/24

Equity fund managers raise S&P 500 CME net long position by 9,236 contracts to 939,368

Equity fund speculators trim S&P 500 CME net short position by 32,395 contracts to 333,288

Japanese yen net short position is -162,151 contracts

Euro net long position is 32,723 contracts

British pound net long position is 28,252 contracts

Swiss franc posts net short position of -31,764 contracts

Bitcoin net short position is -153 contracts

Gold NC Net Positions climbed from previous $199.3K to $207.3K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5104

Daily VWAP bearish

Weekly VWAP bearish

Above 5110 opens 5150

Primary resistance 5180

Primary objective is 5000

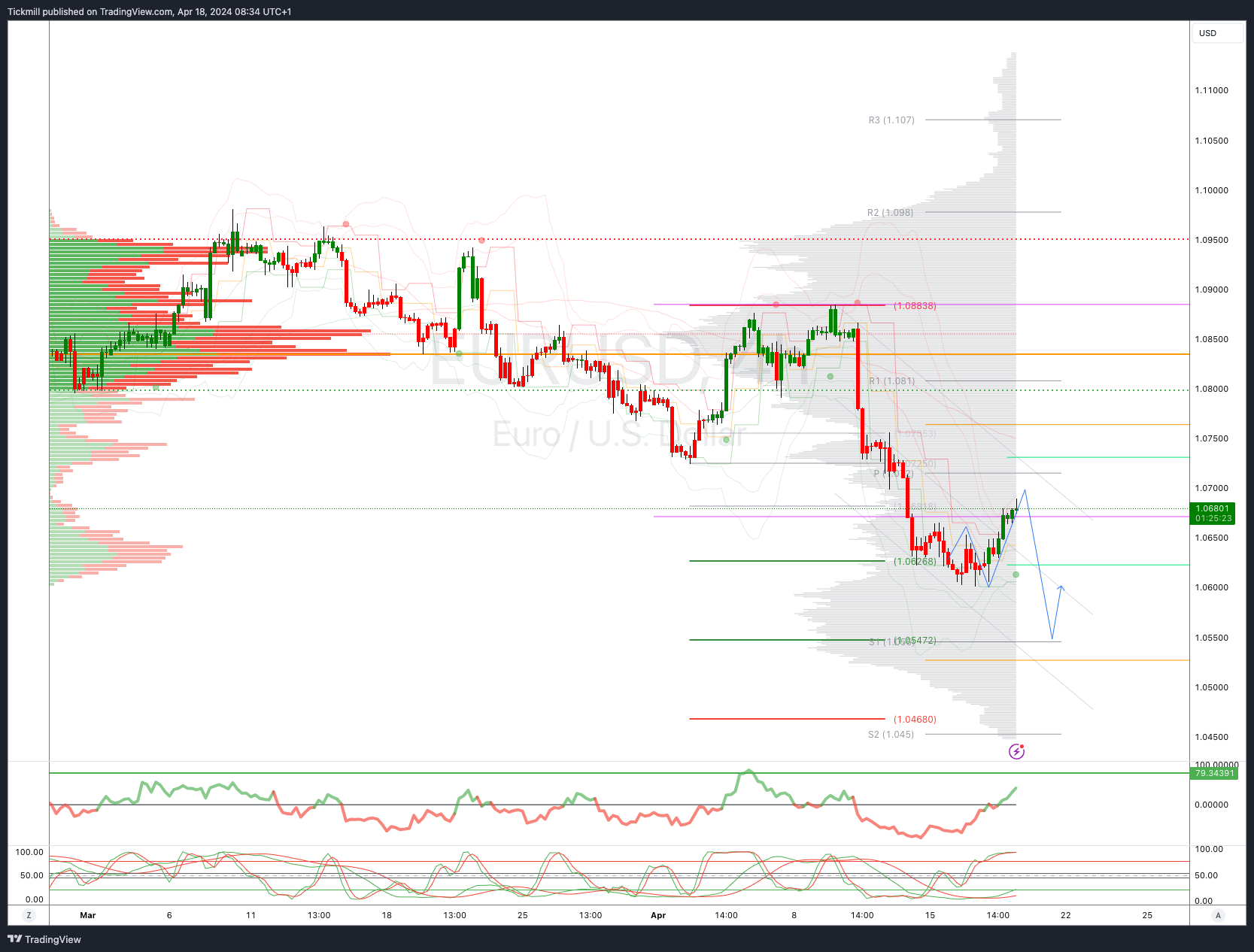

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

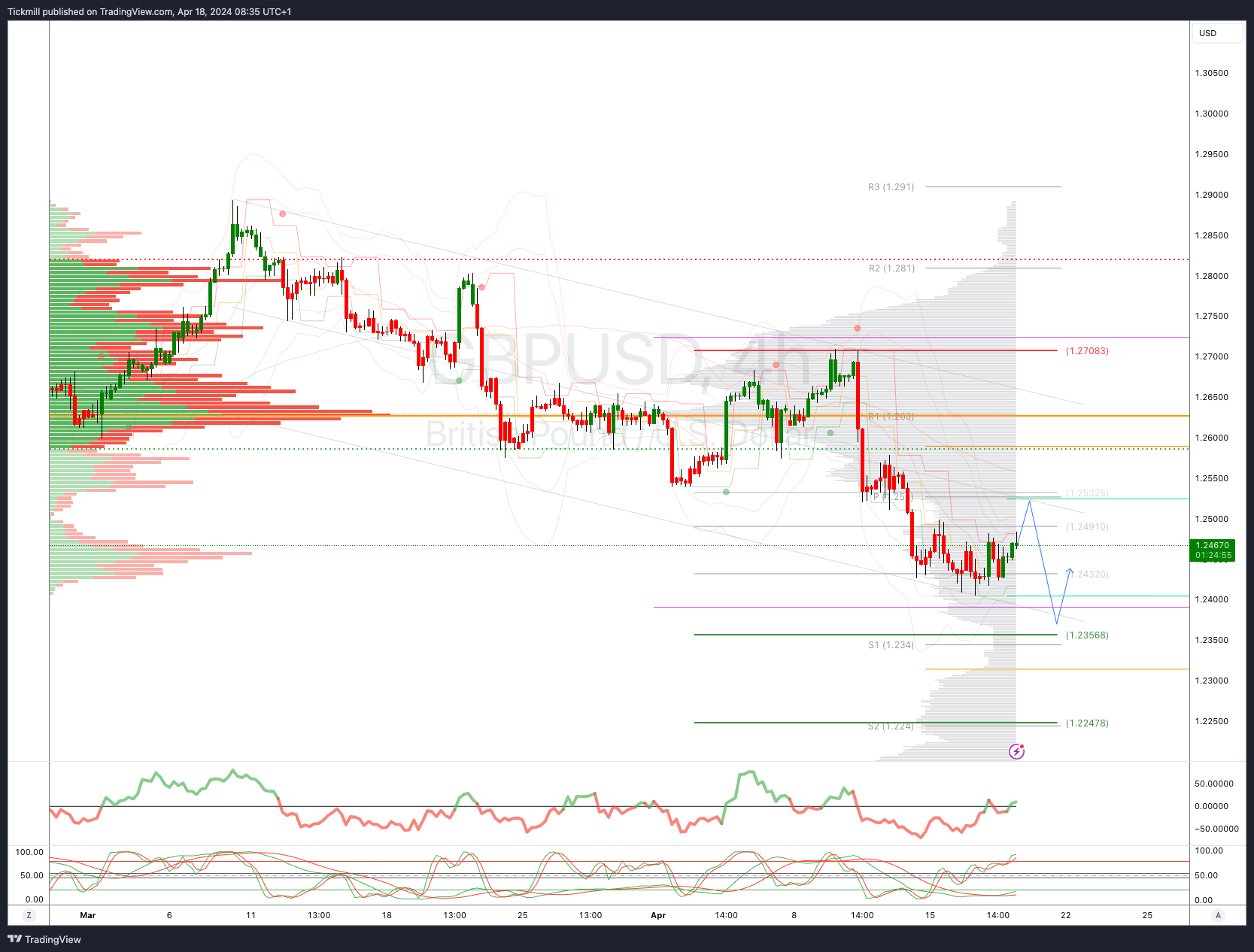

GBPUSD Bullish Above Bearish Below 1.25

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2560 opens 1.2650

Primary resistance is 1.2650

Primary objective 1.2350

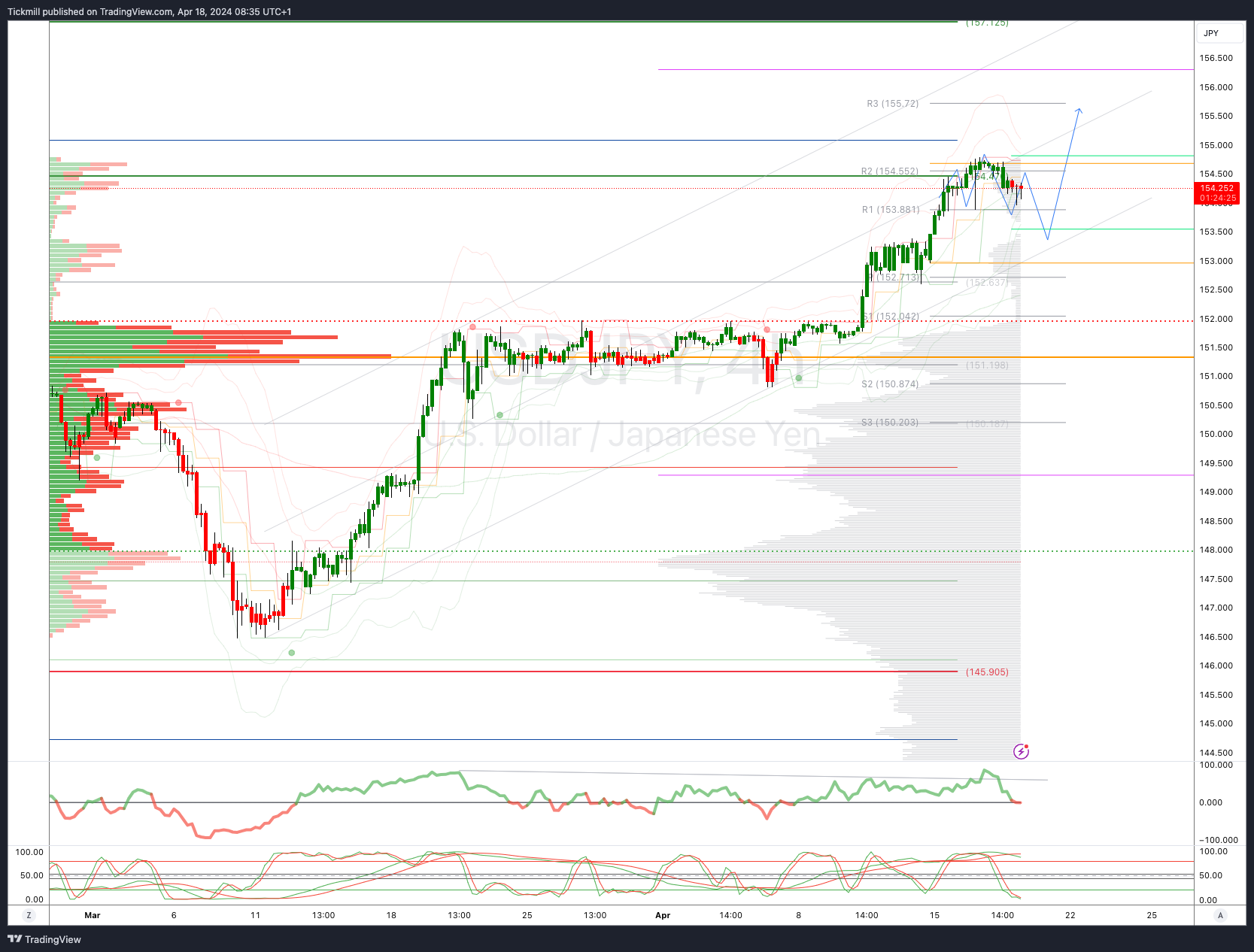

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

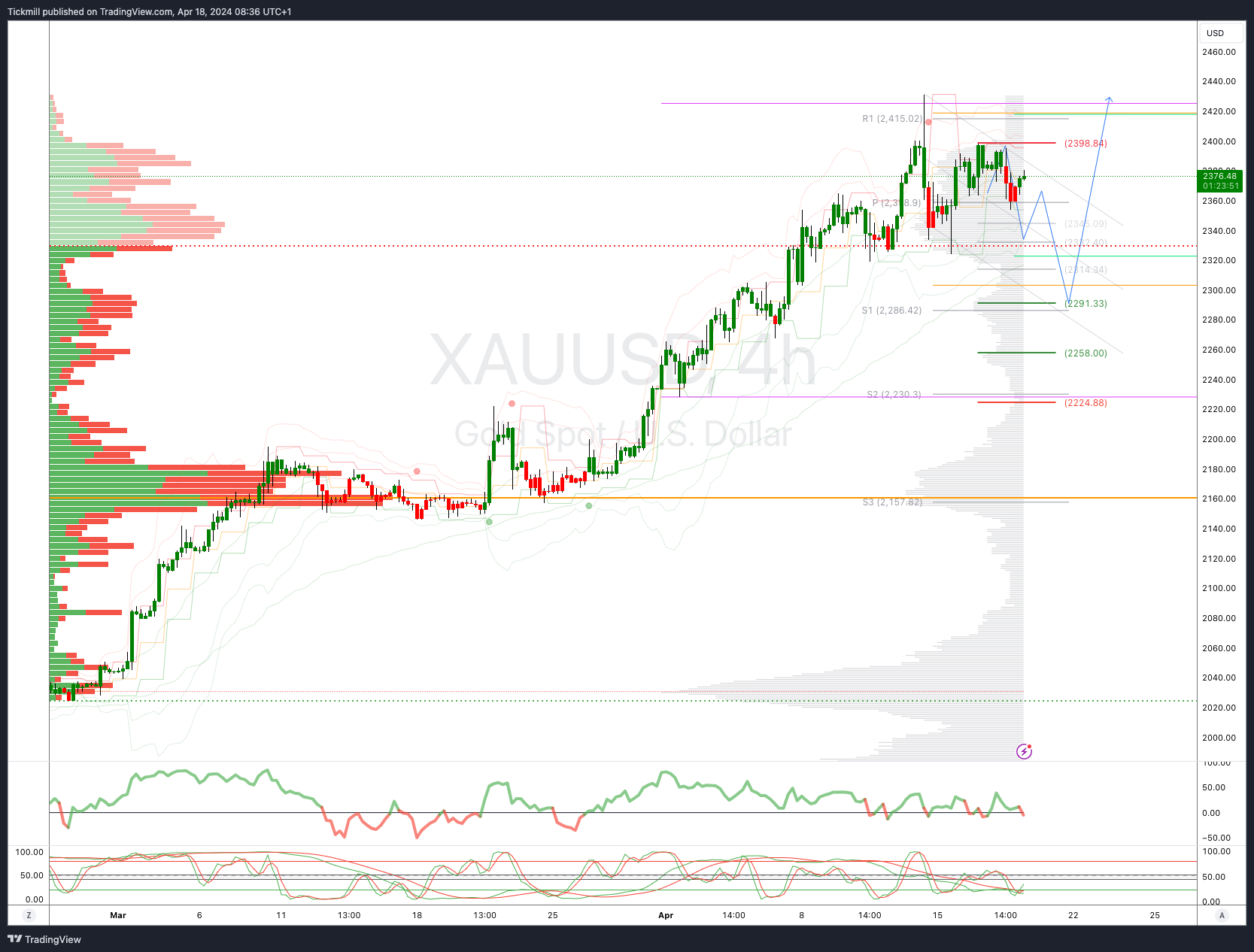

XAUUSD Bullish Above Bearish Below 2395

Daily VWAP bullish

Weekly VWAP bullish

Below 2380 opens 2330

Primary support 2284

Primary objective is 2430 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!