Daily Market Outlook, April 19, 2024

Munnelly’s Macro Minute…

“Middle East Tensions Escalate Overnight Sinking Risk Sentiment”

Global markets were rattled by fresh unrest in the Middle East, leading to a decline in stocks while safe-haven assets like Treasury bonds and the dollar saw a surge in value.

Treasury bond prices went up, causing the 10-year yield to drop by as much as 14 basis points. The dollar index rose by up to 0.6%, and other safe havens like the Swiss franc, yen, and gold also experienced gains. According to sources from the US, these movements were in response to Israel's missile attack on Iran, which occurred shortly after Tehran's rocket and drone attacks. This raised concerns about a broader conflict in the Middle East. However, some of the risk-off swings in the markets were reversed when Iran assured the safety of its Isfahan nuclear plant.

The price of oil surged by more than 4%, with Brent oil reaching over $90 per barrel before dropping below that level. Additionally, the credit default swaps index for Asia outside Japan saw its largest daily increase in over eight months. Futures contracts for the S&P 500 and Nasdaq 100 dropped by over 1% after the actual benchmarks experienced a sixth consecutive day of decline on Thursday, as expectations of a Federal Reserve interest rate cut were adjusted. Asian stocks, including those in Japan and Hong Kong also posted losses of circa 1%. It is noteworthy that markets have recovered from overnight lows as the situation hasn’t escalated with Iranian officials claiming there is no plan for immediate retaliation.

Recently released UK retail sales data for March showed no overall change, with a 0.3% monthly decline in sales excluding fuel. This outcome was weaker than anticipated but aligned closely with our own projection of a slight decrease. Unofficial reports suggesting a sales increase in March may have been influenced by the early Easter effect, which is adjusted for in the official data's seasonal adjustments. Additionally, the dampening effect of wet weather during the month may have impacted activity. Despite the current figures, retail sales are expected to contribute positively to GDP growth in Q1, following increases in January and February, potentially aiding an early rebound from recession. Furthermore, certain indicators for consumer spending are showing improvement, including faster wage growth compared to inflation and a resurgence in consumer confidence.

Today's economic calendar is relatively light, lacking significant data releases. However, attention is focused on potential market-moving statements from central bank policymakers as the IMF's semi-annual conference concludes. Scheduled speakers include Bank of England officials Ramsden and external Monetary Policy Committee member Mann. Mann is regarded as the most hawkish member of the BoE's interest rate-setting Committee and is unlikely to support a rate cut in the near term. Ramsden, an internal member, may lean towards such a move, making his remarks on the topic noteworthy. He will participate in a panel discussion on monetary policy responses to post-pandemic inflation. Other speakers today include Goolsbee from the US Federal Reserve and Nagel from the European Central Bank.

Overnight Newswire Updates of Note

Israel Strikes Targets In Iran As Middle East Tensions Rise

Israeli Missile Strikes In Iran "Limited" In Scope; Not By Manned Aircraft

Fed's Bostic: Open To A Rate Hike If Inflation Progress Stalls

Kashkari Says Fed Could ‘Potentially’ Hold Rates Steady All Year

ECB's Simkus Says Several Interest Rate Cuts Are Most Likely

ECB's Panetta Says Disinflation Is Advanced And Continuing

Japan’s Inflation Cools Ahead Of BoJ Policy Board Meeting

Money-Market Assets Drop Most Since 2008 As Tax Day Takes Toll

Oil Surges On Concerns Of Escalating Conflict In The Middle East

Gold Surges Past $2,400 On Middle East Conflict Concerns

Nikkei Dives 1,300 As Concern Over Middle East Spurs Selling

Netflix Reports Strong Sub Gains But Q2 Rev Forecast Disappoints

Apple Removes WhatsApp From China App Store On Gov Orders

Sony In Talks To Team With Apollo To Bid For Paramount

L’Oreal Bounces Back As Europe, North America Offset Weak China

S&P Downgrades Israel Rating On Heightened Geopolitical Risk

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0570 (618M), 1.0600 (650M), 1.0635-45 (2.3BLN), 1.0675 (624M), 1.0700-10 (599M)

GBP/USD: 1.2400 (400M) , 1.2470 (209M), 1.2520 (221M)

EUR/GBP: 0.8530 (204M), 0.8550 (181M)

AUD/USD: 0.6400 (466M), 0.6415-20 (1.4BLN), 0.6475 (442M)

AUD/NZD: 1.0850 (216M), 1.1050 (300M)

USD/CAD: 1.3700 (1.8BLN), 1.3750 (484M), 1.3775 (788M), 1.3820 (513M)

USD/JPY: 154.25 (200M), 155.00 (2BLN)

AUD/JPY: 100.00 (300M), 101.00 (375M)

CFTC Data As Of 12/04/24

Equity fund managers raise S&P 500 CME net long position by 9,236 contracts to 939,368

Equity fund speculators trim S&P 500 CME net short position by 32,395 contracts to 333,288

Japanese yen net short position is -162,151 contracts

Euro net long position is 32,723 contracts

British pound net long position is 28,252 contracts

Swiss franc posts net short position of -31,764 contracts

Bitcoin net short position is -153 contracts

Gold NC Net Positions climbed from previous $199.3K to $207.3K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5010

Daily VWAP bearish

Weekly VWAP bearish

Above 5010 opens 5050

Primary resistance 5150

Primary objective is 5000 - TARGET HIT NEW PATTERN EMERGING

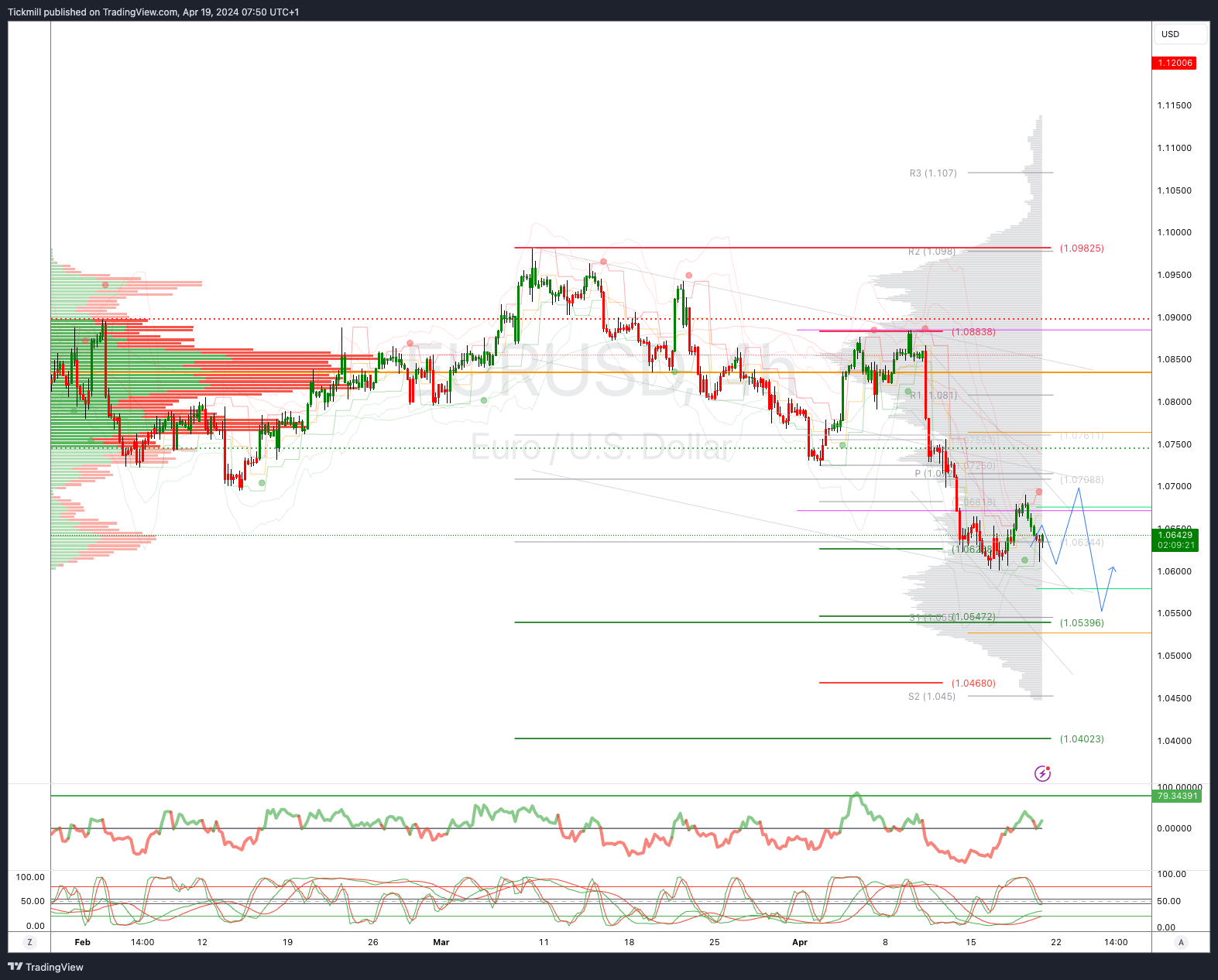

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.25

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2560 opens 1.2650

Primary resistance is 1.2650

Primary objective 1.2350

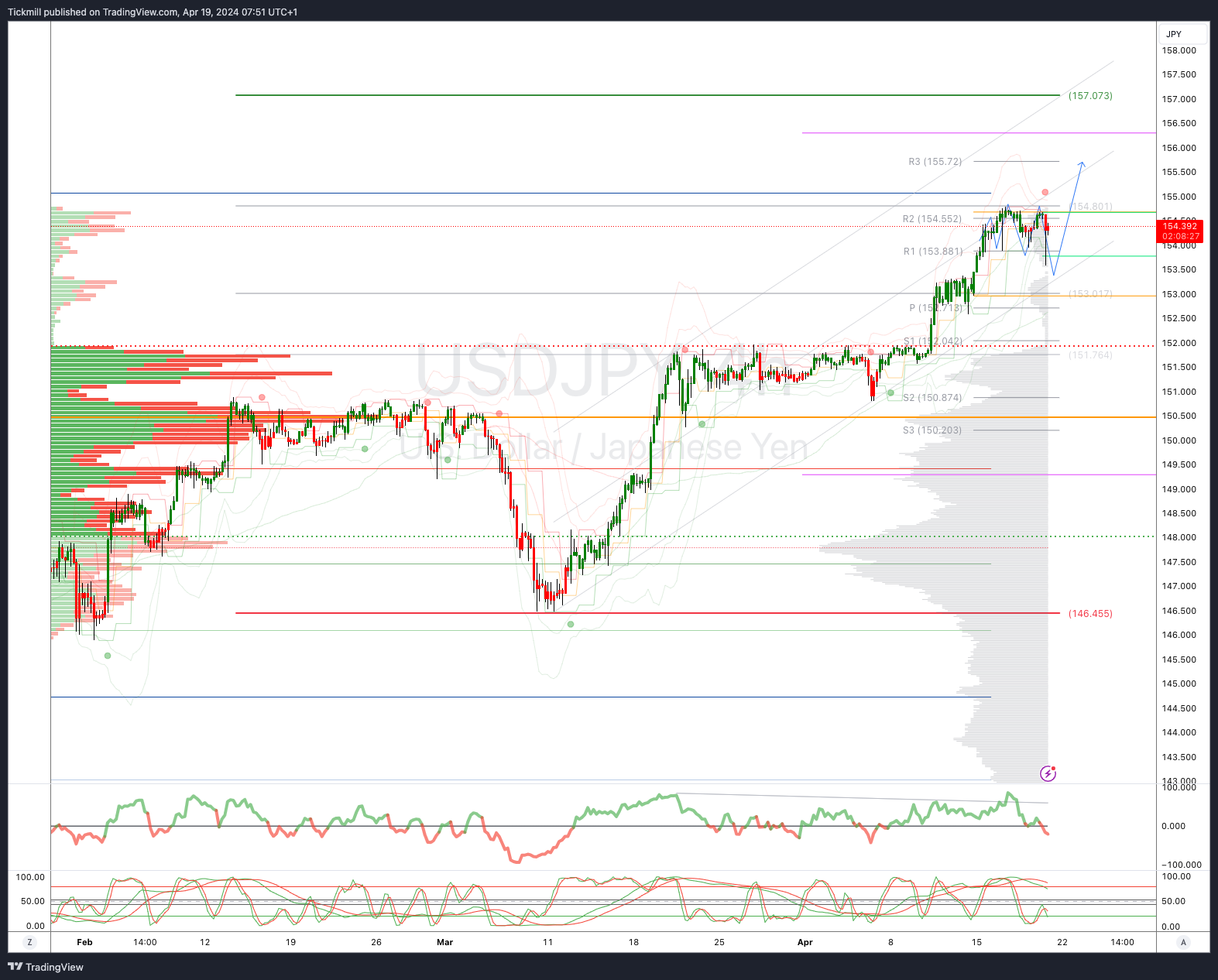

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

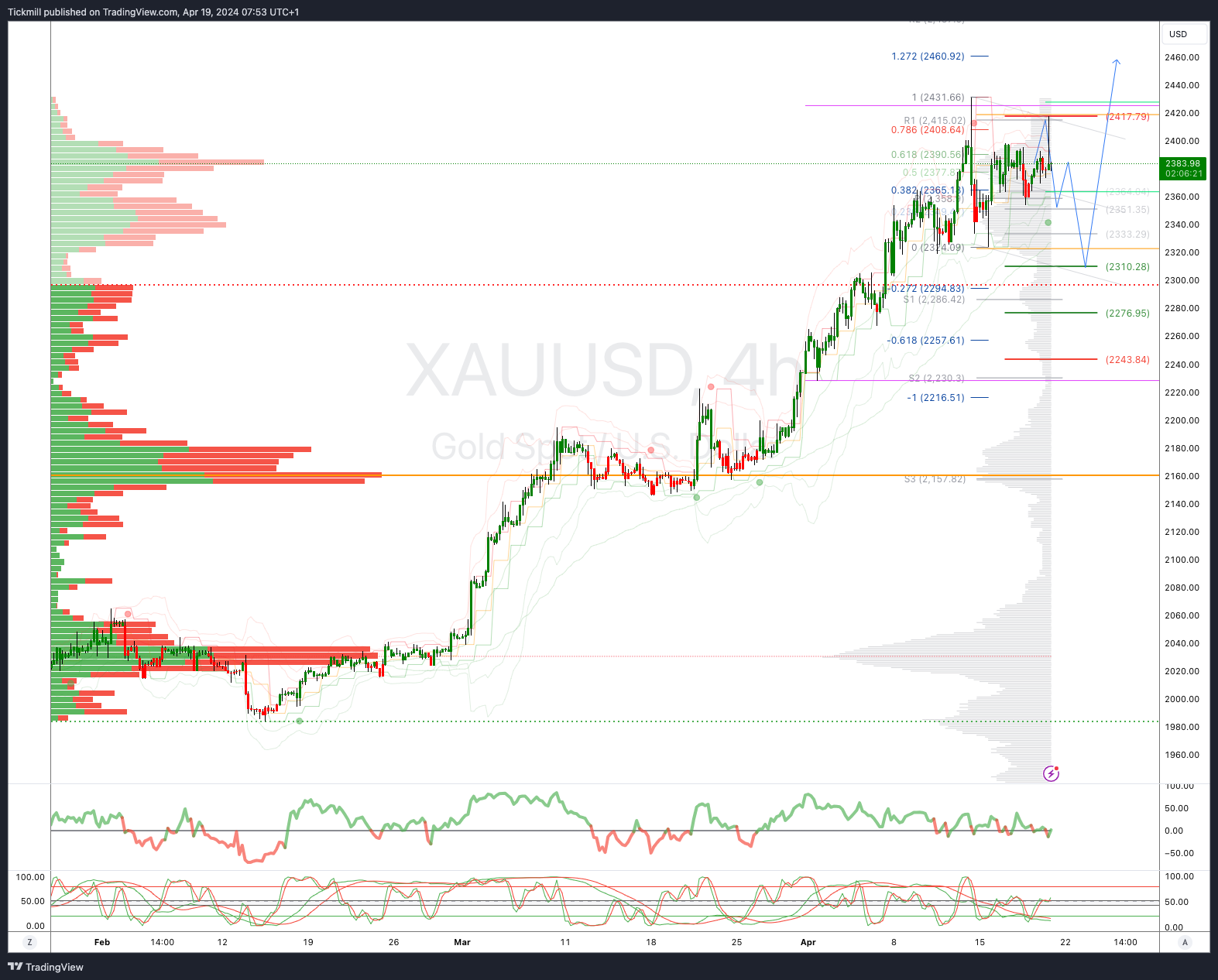

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bullish

Weekly VWAP bullish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 7800

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!